Axis Mutual Fund launches ‘Axis NIFTY Smallcap 50 Index Fund’

(An Open Ended Index Fund tracking the NIFTY Smallcap 50 Index)

Highlights:

- Category: An Open Ended Index Fund tracking the NIFTY Smallcap 50 Index

- Benchmark: NIFTY Smallcap 50 TRI Index

- Fund Manager: Jinesh Gopani, Head-Equity

- NFO open date: 21st February,2022

- NFO close date: 7th March, 2022

- Minimum Application Amount: INR 5,000 and in multiples of INR 1/- thereafter

- Exit Load: Nil

Mumbai, February 21, 2022: Axis Mutual Fund, one of the leading asset management companies in India announced the launch of Axis NIFTY Smallcap 50 Index Fund,(an Open Ended Index Fund tracking the NIFTY Smallcap 50 Index) today. Managed by Jinesh Gopani, Head - Equity, the fund will track the NIFTY Smallcap 50 TRI Index. The NFO opens for subscription on 21st February 2022 and closes on 7th March, 2022. The minimum application amount is INR 5,000 and investors can invest in multiples of INR 1, thereafter. The exit load is Nil.

Axis NIFTY Smallcap 50 Index Fund and the underlying index

Rebalanced on a semi-annual basis, the NIFTY Smallcap 50 Index represents top 50 companies selected based on average daily turnover from the top 100 companies selected based on full market capitalization in NIFTY Small cap 250 Index. This index is computed using free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to particular base market capitalization value.

The Axis NIFTY Smallcap 50 Index Fund is structured in a manner to look for Quality, Scalability, and Stability in its portfolio. By relying on the market’s ability to identify niche high performing growth businesses, the fund will be selecting the most liquid small caps by average daily turnover over a 6-month period. Furthermore, higher weights will be assigned to companies with larger float and securities will be excluded if stock falls below the 130th rank based on full market cap. For more details visit www.niftyindices.com.

Smallcaps have been known to be alpha generators in Growth Cycles. Characterised as high growth companies with niche businesses aiming to disrupt the status quo, they have a high risk-high reward quotient. Further aided by the passively managed nature of the fund, the fund can be an ideal option for investors looking for market-linked returns and long term wealth creation solutions. Investors can look to invest through various systematic options like SIPs, STP’s to adopt a more disciple approach or invest via lumpsum.

Mr. Chandresh Nigam, MD & CEO, Axis AMC said, “When it comes to Smallcap companies, who can be considered at the stepping stones to Midcaps and Largecaps, only good quality-oriented companies are able to make the transition. With the introduction of the Axis NIFTY Smallcap 50 Index Fund, we are hoping to drive alpha for our investors while maintaining focus on Quality, Scalability, and Stability in the portfolio. It aligns with our belief of offering quality products to investors that suits their risk appetite and need to yield long term wealth creation opportunities.”

Source: NIFTY Indices, Axis MF Research as on 31st January 2022

For detailed asset allocation & investment strategy, kindly refer to scheme information document

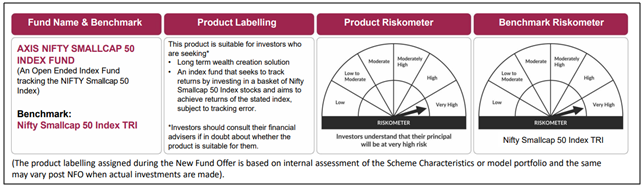

Product Labelling:

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments.

Note: Market caps are defined as per SEBI regulations as below: a. Large Cap: 1st -100th company in terms of full market capitalization. b. Mid Cap: 101st -250th company in terms of full market capitalization. c. Small Cap: 251st company onwards in terms of full market capitalization.

NSE Indices Limited Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE.

The Axis NIFTY Smallcap 50 Index Fund offered by “the issuer” is not sponsored, endorsed, sold or promoted by NSE Indices Limited (formerly known as India Index Services & Products Limited (IISL)). NSE Indices Limited does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of Axis Nifty Smallcap 50 Index Fund or any member of the public regarding the advisability of investing in securities generally or in the Axis NIFTY Smallcap 50 Index Fund linked to Nifty Smallcap 50 Index TRI or particularly in the ability of the Nifty Smallcap 50 Index TRI to track general stock market performance in India. Please read the full Disclaimers in relation to the Nifty Smallcap 50 Index TRI in the in the Offer Document / Prospectus / Scheme Information Document.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. The fund manager(s) may or may not choose to hold the stock mentioned, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)